One of the questions that I often get asked by prospective financial coaching clients is:

“Do you think you’d be able to teach me how to manage my own portfolio”

The answer is always yes.

I have NEVER met anyone who said that they were incapable of running their own online bank account. I never met anyone unable to to deposit some money, pay a utility bill and make a withdrawal from an online bank account.

This is good news because it’s as simple to invest your own portfolio as it is to run an online bank account.

Personally, I find new online bank accounts to be a little bit of a pfaff to set up…not because it’s hard (it isn’t) but because we’re creatures of habit and we’re just not used to what we’re not used to. A new bank account means a new user interface and learning where all the buttons are.

But let’s be honest, it’s not hard. It’s like 15 minutes to upload a passport / driving licence, fill in your name, address and date of birth. Honestly, who can’t do that??

And, if you can do that for a bank, you can do that for Vanguard or an alternative online broker / investment platform.

But what about asset allocation? What about tax shelters? What about re-balancing? What about the difference between income and accumulation units? What about the differences between ETFs and mutual funds? What about <the other things>?

Yes, yes, yes…these are all important. That’s why there is an article about each of these on The Escape Manual. But let’s take things one step at a time. You can cross your bridges as you come to them. You can learn as you go along.

The only mistake that can’t be fixed is procrastination…because you never get that time back. This is why I say: Get Rich Slowly, Get Started Quickly.

But what about if our rookie investor makes a mistake?

No problem, in personal finance there are very very few “mistakes” that can’t be fixed.

For example, let’s say you bought the “wrong” fund.

Firstly, that is super-unlikely. You get all the time in the world to familiarise yourself with the platform before making a trade. You can read the fund fact sheets. You can start by buying just £100 of the fund. You can get comfortable with the user-interface before investing larger amounts.

And secondly, you can always switch it later. I don’t encourage frequent trading but you can always sell it and buy a different one. (Vanguard’s platform offers commission free trading…and no, they don’t pay me to shill their product).

And thirdly, how do you know that it really was the wrong fund? For all anyone knows, it may outperform the “right” fund!

That’s the thing about financial markets; if anyone knew with certainty what the “best” assets / companies / funds were going to be, their price would get bid up to the point where their future returns would be lower. So then they would no longer be the best (performing) funds.

So no one knows for sure in advance which the best-performing funds are going to be (if only it were that easy!).

But we can say we with reliability what the best funds look like. The best equity index funds have low fees (less than 0.25% per year) and the widest diversification across companies, countries and industry sectors.

The glorious fairness of free and efficient markets is that when you the rookie investor buys the Vanguard FTSE Global All-Cap Index Fund (or VWRL or whatever..there are lots of good options out there) you get exactly the same pricing as the world’s smartest investors. You get the same deal as Goldman Sachs, Blackrock, JP Morgan etc etc, the same deal as big hedge funds and other institutional investors.

Any reasonably intelligent person can learn the power of compounding, how index funds allow you to buy a slice of the entire global economy and how financial markets “price-in” the future possible states of the economy.

But first you may have to unlearn some of what you have learned. It’s time to let go of the marketing material of the financial services industry.

For example, consider that staple question: What is the investment outlook? Most of the time, this is a dumb question – the more uncertain the economic outlook, the more likely it is that stocks are cheap and future returns will be higher.

This is why focusing on The News is such a mistake. I think of The News as The University of Learned Helplessness.

A better approach would be to focus on what you can control (getting started, saving and investing more, lowering fees etc) and stop worrying about the things that you can’t.

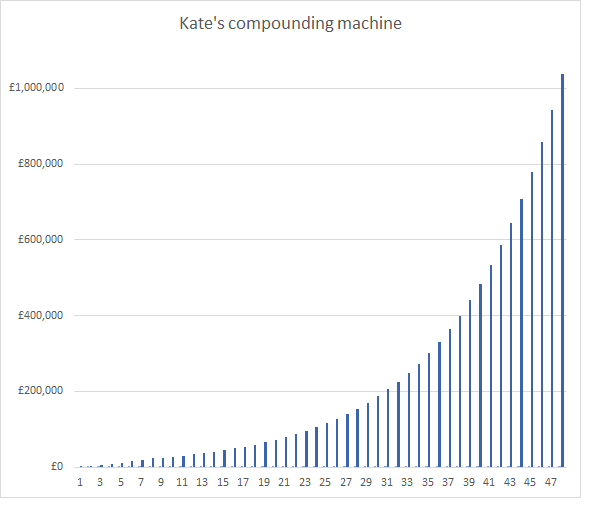

To illustrate the power of starting investing early and low fees, let’s return to the example of Kate…a bright school leaver who gets a job aged 18. Over the next 7 years (18-25), our heroine saves £167 per month for a total of £15,000. Kate does nothing for the next 40 years (and no more saving) and gets the same annual return (~10%) as the S&P 500 has done over the last 100 years or so.

At age 65, Kate fires up her laptop and is pleasantly surprised to see that her £15,000 of contributions have grown to just over £1 million. True, inflation means that a million pounds isn’t worth as much as it used to be. But still…not too shabby. You can check out the maths for yourself here.

The problem is that if Kate pays 2% per year to her financial adviser / fund manager / wealth manager, she only gets 8% per year (10 – 2 = 8!). And at 8% per year, her pot does not grow to £1 million, it only grows to £457,000.

2% fees have cost her more than £543,000! This is the prize available for managing your own money.

There is of course a big difference between simple and easy. It is very simple to manage your own portfolio.

But it is not easy because your money is at stake and those numbers on the screen represent our hopes, fears and dreams for the future.

This is why you will need some degree of emotional control when the stockmarket goes down – as well as up – as it does in the normal course of business.

You will need to be ready for years when the stockmarket doubles as well as for years when the stockmarket halves. The appropriate response to both of these is to just keep buying: to continue dollar cost averaging in over time.

You will find these things become easier after you have lived through a full bull & bear market cycle whilst managing your own portfolio. You just have to think long-term and be ready for a roller-coaster ride.

Important regulatory notice: I don’t give regulated investment, tax or legal advice. I don’t give product recommendations and I don’t take your money away to invest. You have to make your own decisions. In short, it’s about helping people learn to “fish” rather than selling them fish!

How long does it take to get started?

Well, it should definitely require no more than 2 hours of your time.

This is why my main coaching option includes 2 hours coaching time per year plus access to all the more detailed articles on investing in The Escape Manual.

What if you need more time than that? No problem, I don’t keep timesheets and any client with an ongoing subscription to this package gets all the coaching time on Zoom / Gmeet that they need.

One client had done all their own research on equity investing, compounding and volatility. They had picked a fund and knew what they wanted to buy. But they were still mentally stuck. They came round to my house with their laptop to click the buy button. It was as if me being there somehow warded off The Evil Demon of Procrastination. Whatever the reason, it worked. They now can’t believe how easy it was in hindsight.

It is natural to be cautious. But eventually you will come to agree with me.

Why? Because you are smart and it really is that simple to invest your own portfolio.

You can book a free introductory call here if you are interested in financial coaching.

Love to everyone

Barney

This articles was first published on Substack – subscribe to get emailed new articles as soon as they come out.