Tag Archives: financial coaching

If more people did money like they play Monopoly, they’d be a lot better off

Consider the following: Nobody ever went to Monopoly Business School and yet on some level everyone knows how to win at Monopoly. For those who’d like a quick reminder, here’s how you win at Monopoly: Similarly, we could say that everyone knows (on some level) what they should do to get rich(er). It’s just that […]

Why do so many people hate their jobs?

Bio-chemistry is upstream of everything Bio-chemistry is upstream of your success in life including your performance at work, promotions and career change…all of which are easier when you are full of energy and confidence. Your bio-chemistry dictates your health, your energy levels and your ability to do hard things. Your bio-chemistry determines your lived experience. […]

It’s as simple to invest your own portfolio as it is to run an online bank account

One of the questions that I often get asked by prospective financial coaching clients is: “Do you think you’d be able to teach me how to manage my own portfolio” The answer is always yes. I have NEVER met anyone who said that they were incapable of running their own online bank account. I never met anyone […]

The purpose of money is to get you the lifestyle that you want

The purpose of money is to get you the lifestyle that you want and improve your quality of life. If you get rich but never use your money for this purpose, it’s like saving your fire extinguisher when your house is burning down…it’s just hoarding. Lifestyle includes where you live, who you spend time with […]

Financial guidance done properly

Before I started financial coaching, I asked myself the following question: “What would financial guidance look like if it were done well?“ What if we could give guidance that reflected the true importance of saving, minimalism (avoiding consumerism), compounding and low investment fees? What if we didn’t have to sell / recommend / push products […]

Geographic arbitrage and the beauty of having a Plan B

I once helped cure the financial anxiety of a French fund manager. He was stressed out by his job (he was worried – with some justification – that the robots were coming for him) and his London lifestyle. Perhaps you too would like to feel less anxious (and get better with money)? If so, please continue and I […]

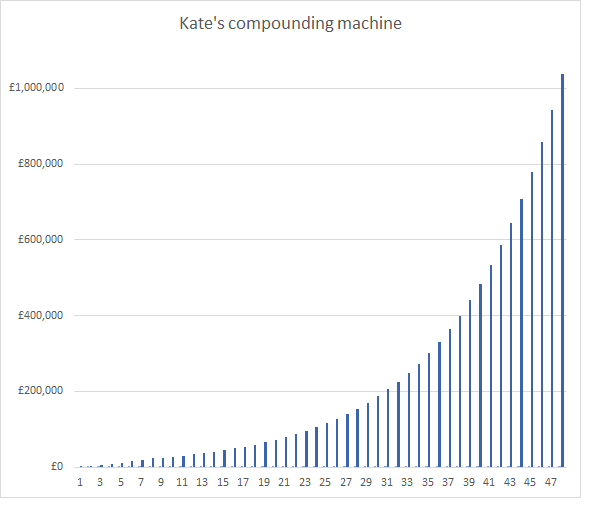

Get Rich Slowly, Get Started Quickly

Getting rich slowly is the safest way. Getting rich slowly is the most reliable way. It may be the only way. Waiting to win the lottery is waiting to be chosen by a universe that’s indifferent to our existence. Day trading and other forms of gambling only makes the banks, bookies and brokers rich. Working at […]

The more runway you have, the safer you are

My Dad once learned how to fly a microlight, a flying contraption that looks like a bit like a hang glider attached to a lawnmower. It’s probably not the safest hobby you could choose. He learned to fly this thing at a rustic airstrip which, by all accounts, was just a grass field with a hedge […]

What if never working again was just The Hook?

I think of quitting work and never working again as “The Hook” of financial independence. It’s the thing that first captures people’s attention. How do we know this? Well, it’s always the thing that the mainstream media focus on when they feature financial independence. The Media know they have to lead with something that catches people’s […]

The Ten Commandments of Index Investing

Much of life is too complicated to be boiled down to just a few simple rules to follow. But it is possible to make investing clearer and simpler than the media and financial services industry have. So listen up heathens…here are the 10 commandments of simple low-cost equity investing. 1. Know thy purpose Money is […]