Most people struggle to save for retirement and can’t see that financial independence is even a possibility.

So most personal finance content is either primary skool level (save 10% on your utility bills) or, at the other extreme, over-engineered (e.g. super-arcane detail on pension law) or designed to sell product (e.g. insurance policies, expensive gimmicky funds or – worst of all – options / FX / stock trading courses).

In other words, I believe that most personal finance content is not fit for purpose.

I submit to you that one of the big challenges of our age is – wait for it – the lack of big challenges.

The pursuit of financial independence provides just such a challenge. It’s a goal that provides long term direction.

Having direction is a superpower. It forces you to actively participate in the game of life rather than merely watching from the sidelines. The fact that financial independence is ridiculously ambitious is a feature not a bug.

Why do so many people now struggle with lack of meaning & purpose?

Throughout history, when most people were operating close to survival level, lack of meaning was just not a thing; a day survived was a win.

The problem we now have is that our practical & tangible struggles got replaced with existential voids. In other words, the trap of consumer society is that its just too easy to coast along and muddle through.

Ladies and Gentlemen, that is simply not acceptable for our purposes.

I think of health, wealth and relationships as the three legs of The Stool of Life.

A stool is strong and balanced only when all of the legs are sturdy.

So you can go Monk Mode (where you go “all in” at work or in your business and ramp up your % savings rate very high) but the question is whether you will be paying too high a price in terms of your long term health and relationships?

I was asked by someone this week how much should I be saving? My answer for them was to get their % savings rate as high as possible, but stop before getting to the point where their spouse divorced them.

I exaggerate for effect but you get the idea. There are no cookie-cutter solutions that work for everyone…there are only trade-offs.

If the average middle class person leaves college at say 21, they typically spend the next few years trying to get established in their career or profession.

There are qualifications to secure. Medical / legal / accounting schools to attend. Software languages to learn. Jobs to apply to. Flats to rent. Dating opportunities to be explored.

As a general observation, many people don’t get their financial wake-up call until they are say 30 – 32 years old.

By this, I mean that for most people, the penny doesn’t drop about the importance of getting your financial shit together until they are into their 3rd decade on this planet.

Everyone’s financial wake up call is slightly different but I still remember mine with 100% clarity. I was 30 and holding my first child’s legs in the air whilst I wiped off the shit changed her nappy.

It was at that point that I realised I had another 18-21 years to go ON THAT ONE ALONE…and the next two children would be extra time added on.

Jeeez…it’s no wonder the birth rate is falling.

Once you have realised the power of compound interest, you will probably regret the lost years where you delayed getting your compounding machine up and running.

In the human world (business, workplace, relationships) everything is potentially negotiable. But the laws of mathematics are not negotiable.

The maths of compounding is like gravity…or The Terminator; it accepts no excuses and no compromises; it can not be reasoned with, it can not be bargained with.

This is why I say Get Rich Slowly, Get Started Quickly.

Can you see the problem here?

I got my financial wake up call AFTER I had already made some of my biggest life decisions…and my biggest financial decisions…e.g. what career to pursue, where to live, whether to get married or not, whether to have children…etc etc. Life is messy like that.

Contrary to popular belief, the nuts and bolts of personal finance are straightforward enough that I believe that any middle class professional or savvy, business-minded person can be taught to do it themselves (with help).

The challenge is not getting the information (we live in an age of information abundance and information overload).

The challenge is sticking to The Path through the ups and the downs, the vicissitudes of life. Here I am talking about either dodging or dealing with things that come out of left field.

I’m talking about the career mis-steps, the job we shouldn’t have taken, the missed promotions, the performance improvement reviews, avoiding obesity & chronic disease, avoiding addictions, getting your partner on the same page as you re money… or, if all else fails, getting through a divorce intact…these are the things that really move the financial needle.

These are some of the things that I help people with in my coaching…in addition to my “bread and butter” work helping people think about investment strategy, asset allocation, automating your finances and allowing your compounding machine to run mostly on auto-pilot.

Talking of avoiding disasters, I recently published “How To Cure Depression” on The Escape Manual.

When I previously touched on the subject of depression on my public blog a few years ago, I got flak in anonymous online comments for suggesting that lifestyle factors (sleep protocol, exercise, light exposure, diet and nutrition, supplements etc) were important and should be tried before drugs.

My anonymous online critics seemed to take my comments as somehow downplaying the seriousness of their condition or as implicit criticism of them personally. Obviously that was not the case but they felt what they felt.

Such are the perils of sharing your thoughts publicly. I guess this is why God invented the paywall.

The Verve were on to something big with their 1997 song The Drugs Don’t Work.

We know that the current batch of drugs for depression don’t work…at least not for everyone and certainly not without some risks of nasty side effects and dependency issues.

What about therapy or counselling?

Well, it’s good to talk…but the limitations of the traditional talk-therapy model are beautifully summarised in the documentary film Stutz. The basic problem is that in traditional therapy, the client is supposed to come up with their own answers – possibly over a period of months or even years.

So problem #1 with traditional therapy is that it’s too slow. And problem #2 is that a patient-led approach might not be effective in cases of depression or other mental health problem where the patient is literally not thinking straight.

In such cases, a more prescriptive approach may be required (e.g. do this, don’t do that). It might be necessary to widen out the approach from just talking to include health and lifestyle interventions (e.g. stop drinking alcohol, start exercising with intensity). This is why (when clients ask for clear guidance) I tell clients exactly what I would do if I were in their situation.

I have been doing behavioural coaching in personal finance and investing for the last 10 years.

I have learned a lot about why people do what they do, why they procrastinate and get stuck.

Wealth is a result…it’s the sum of many actions over years…this is what I mean by The Aggregation of Marginal Gains.

In many ways, personal finance is simple. All you have to do is 1. earn more 2. spend less 3. invest the difference wisely; and 4. know how much is enough

But the reason it’s not easy is because of our emotions, those things that intelligent, logical people struggle with (just as much as the dummies). It’s not always easy to stick to The Path whilst the forces of chaos (advertising, social pressure, The Media, other people’s expectations) intrude into your mind.

I will do personal finance and investing coaching forever…but I still have energy and headspace in my life left over for other stuff.

For the last 10 years I have also been learning about health, nutrition, exercise and wellness. Initially I was fixing the health issues that I got from spending two decades in a stressful job. But as time went on I could see how financial coaching clients could use this health knowledge to change their state and conquer financial anxiety.

The game changed in 2020…all the health trends that had been in place for decades sped up: comfort eating, lack of social connection, obesity, junk food everywhere, drinking alcohol at home, more time online, more screens, disrupted circadian rhythm etc.

The modern world is death by comfort and convenience, death by a thousand cuts.

In 2022 I had to make a choice between alcohol and my health. I chose my health and have not drunk any alcohol for well over a year now. I didn’t make this choice to save money. I mean yes, obviously not drinking is cheaper than drinking but it’s the health benefits that are the real prize.

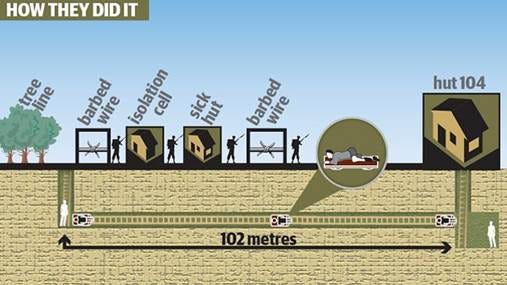

Behold the following graphic which represents the concept of The Prison Camp:

Do you think that it was just a co-incidence that – 10 years ago – I chose an image that included a sick hut and an isolation cell?

No, it was not an accident and not a co-incidence. Health challenges and introversion (aka self-imposed isolation) were big motivations for my journey to financial freedom.

Money is just a tool to get the life that you want… ..and The 3 Pillars of A Good Life are health, wealth and the relationships.

I now have a separate Substack blog for each of these 3 pillars:

- Wealth : Financial and investment coaching

- Health : Health, fitness, lifestyle, nutrition and alcohol-free coaching

- Psychology: People, relationships and psychology coaching.

Thank you for reading…the best is yet to come.

Barney

New articles appear first on Substack – subscribe here to get emailed new articles as soon as they come out.

Approaching retirement prompted a “health, wealth & relationships” review which led to a (Covid-enabled via remote working) move to Italy. Health (med diet, sun, sea, mountains, …), Wealth (cheap houses, 7% tax, 20Euro plumber visits, ..), Relationships (much friendlier locals than when we moved to Devon, non-stop visits from UK friends/family).

Just sold UK house, so now struggling to find an ex-pat investment platform that’s compliant with Italian money laundering laws! Someone recommended Saxo Bank, but I take such recommendations with a pinch of salt.