Consider the following:

Nobody ever went to Monopoly Business School and yet on some level everyone knows how to win at Monopoly.

For those who’d like a quick reminder, here’s how you win at Monopoly:

- Firstly, you have to decide to play…and play to win

- As soon as the game starts, you buy all the assets you can afford…and keep adding

- Once you have bought an asset, you aim to hold it forever

- You stay out of jail

- You try not to stay at hotels that you can’t afford.

- You hope for good luck (it helps).

- You avoid distractions and you stay in the game.

Similarly, we could say that everyone knows (on some level) what they should do to get rich(er). It’s just that only a certain % of people that are willing or able to consistently follow through and do it.

Consider the following thought experiment. Imagine 4 “normal” people playing Monopoly like they conduct their own personal finances.

Player 1 : Ken the Consumer. Ken watches the adverts. He think’s he’s somehow immune to them but actually it’s all sinking in and those consumer mind-viruses are getting stored on his internal “hard drive”. Believes that they would be happy if only they had a faster car / iphone 19 Pro Max S / more Uber Eats. Spends all of their £200 salary on the aforementioned trinkets and so never buys any actual property.

Player 2 : Ben the Borrower. Ben borrows money using a credit card. The credit card carries an interest rate of ~29% per year. Ben uses that cash to buy properties with a rental yield of 5% per year. So…he pays a 29% funding cost and earns a 5% rental yield…can you see the problem here? Ben’s compounding machine is running in reverse.

Player 3 : Dominic the Doomer. Too busy doom-scrolling on their phone to even roll the dice. Dominic’s dopamine system is completely fried by their addiction to News / social media / sugar / junk food / alcohol etc. By complete co-incidence, Dominic is now suffering from poor mental health. Believes a 14 year old girl on Twitter who told them that the whole game is gonna end in 5 minutes time… so what’s the point of even playing?

Player 4 : Frankie the Flipper. Frankie has watched a lot of Youtube videos where someone promotes their amazing proprietary trading system that has beaten the market (over 100% of the time-frames cherry-picked to sell their course). This taught Frankie to day-trade FX options / NASDAQ stocks / shitcoins / etc from home, no experience required.

So now when Frankie lands on Park Lane, he buys the property and then flips it on to another player 5 minutes later for a kwik 3% profit.

Can you see why Monopoly is easier than real life investing?

There are fewer distractions. In the game of Monopoly you do not live in a world of temptations. These temptations encourage people to spend their investment money on consumer trinkets or Get-rich-Kwik schemes.

The Prison Camp system makes it harder for you to escape The 3 C’s: conformity, convenience and consumerism.

It is hard to hold down a high paying job or run a business. But it is simple to manage your own portfolio and create a system that works for you.

You are smart and already knew how to win at Monopoly. You did not need me to tell you this.

But you only really know it if you do it.

Or, to be more precise, you only really know it if you have already done it.

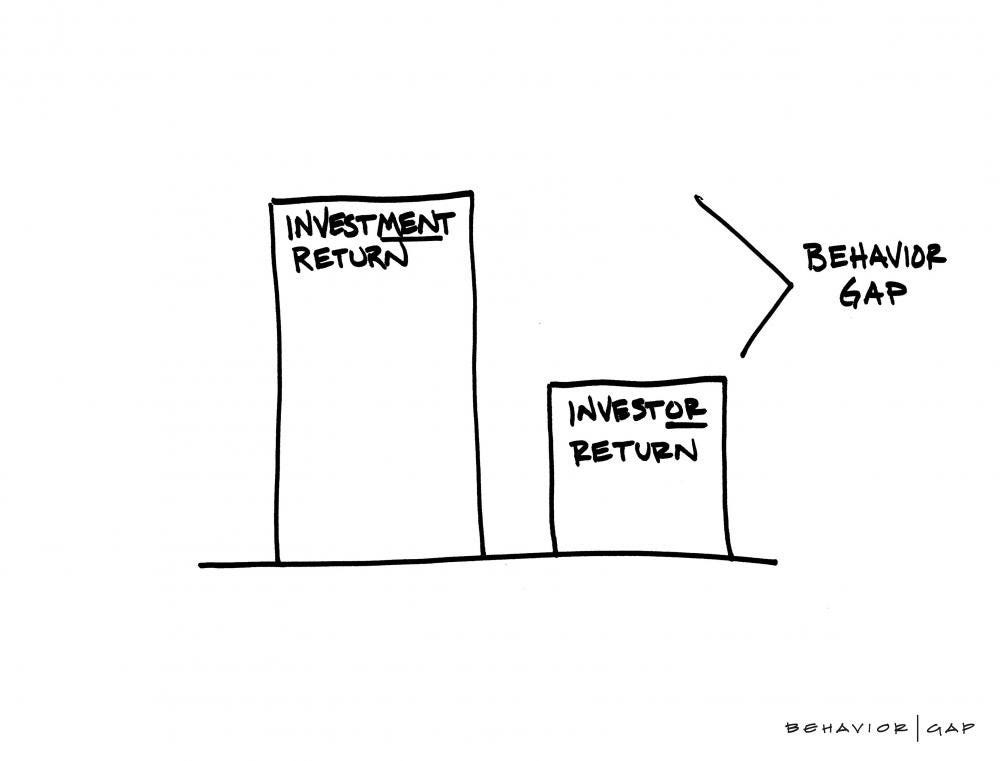

Carl Richards wrote The Behavior Gap: a good book about the gap between 1) what we know that we should do as investors and 2) what we actually do.

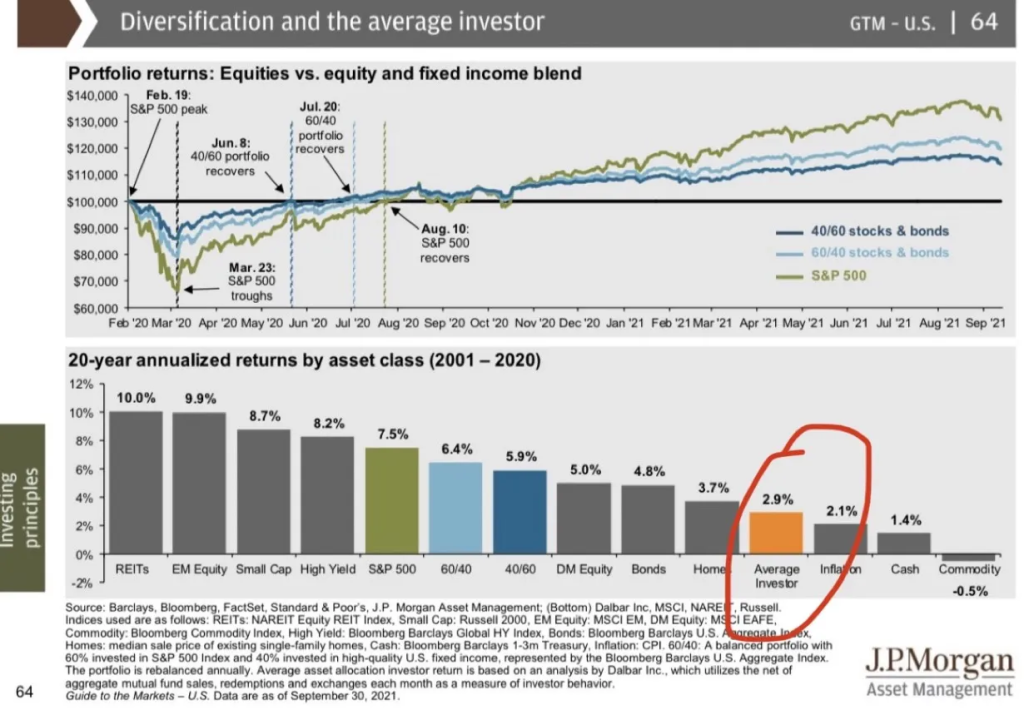

And here is a chart that quantifies the behaviour gap:

That’s right : in a world where equities returned 8-10% per annum, the average investor only achieved 2.9% per year.

Why the gap? Because investors churned their portfolio (more trading incurs more fees), they FOMO’d in and bought at the highs and then capitulated and sold at the lows. This is why it makes sense for most people to £/$ cost average in each month. It’s emotionally easier and that’s generally how we save and invest for the future.

That gap between asset class returns and the returns achieved by the average investors is a shame.

But the even bigger loss is failing to get started in the first place.

The biggest loss is failing to buy assets that will provide you with a growing stream of passive income over time (if get your compounding machine set up correctly).

People are still adjusting to the shock of higher interest rates and increased cost of living. The housing market is on the floor right now. But, make no mistake, a new bull market for all risk assets is on the way and the next one is gonna be a biggie.

Do you already have your earning, saving and investing system up and running on autopilot? Would your portfolio run along happily even if you slipped into a coma for the next 3 months?

Are you using your tax shelters? What is your target asset allocation? How do you track your net worth? Do you have a one-page financial plan?

Get rich slowly, get started quickly.

New articles appear first on Substack – subscribe here to get emailed new articles as soon as they come out.

Carl Richards’s book The One-Page Financial Plan is a good one and I’ve recommended it to people in the past. Easy to pick up, easy to understand, easy to apply.