In horse-racing, they add lead weights to the saddlebags in handicap races.

% fees in investing are like those lead weights

The higher the % fees, the heavier the weight carried by your fund…

Higher % fees will probably lose you the race

I did a webinar this week with a group of health professionals on how to invest with index funds.

I wasn’t paid to do this…I did it as a favour to the organiser (one of my coaching clients) to help her clients.

One of the good things about these DIY investing sessions is the gasps of surprise when you lay out the power of stockmarket compounding (coupled with low fees).

I also get to hear the horror stories of what people are still being quoted for the simplest of investments…like set up a Junior ISA (upfront fee of £750 plus 2% of the pot every year going forward!).

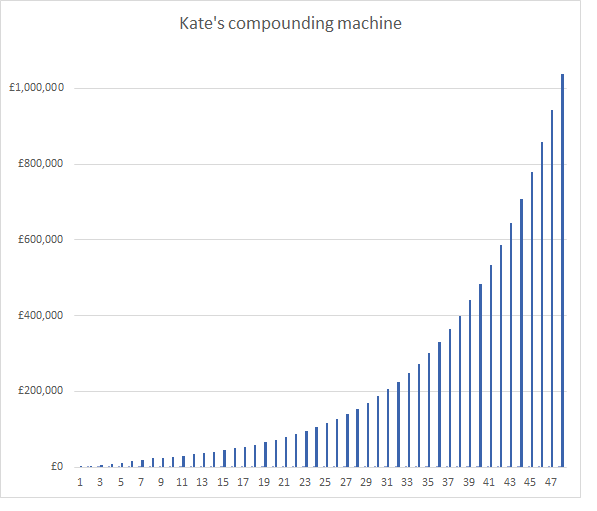

To illustrate the power of low fees, let’s return to the example of Kate…a bright school leaver who gets a job aged 18.

Kate does not go to university and get into debt but instead gets a job and is able to start saving straight away.

Over the next 7 years from age 18-25, our heroine does well and learns how to work hard, deal with people and use basic arithmetic. She does not spend all her salary on consumer nonsense. Instead she pays herself first every month, setting up a direct debit to stash £167 per month (£2,000 per year) for a total of £15,000 over that period.

Kate directs her monthly savings into a low cost equity index tracker until age 25 when she stops making contributions and never saves another penny. Kate does nothing with her pension for the next 40 years and, as a result, she gets the same annual return (~10%) as the S&P 500 has done over the last 100 years or so.

At age 65, Kate fires up her laptop and is pleasantly surprised to see that her £15,000 of contributions have grown to just over £1 million.

True, inflation means that a million pounds isn’t worth as much as it used to be. But still…not too shabby. You can check out the maths for yourself here.

Fuelling the machine

We need to choose what to put into our compounding machine.

Of all the various options for wealth-producing assets, the stockmarket is the easiest (and arguably the safest over the long term) to invest in.

Active property development is hard work and “passive” buy to let properties often don’t earn their opportunity cost of capital.

The stockmarket is the best (and over the long term safest) game in town. When you own a global equities tracker fund, own a slice of the biggest companies in the world. As time goes by you, you reap the rewards of progress as these companies get better at using technology to make stuff and solve problems.

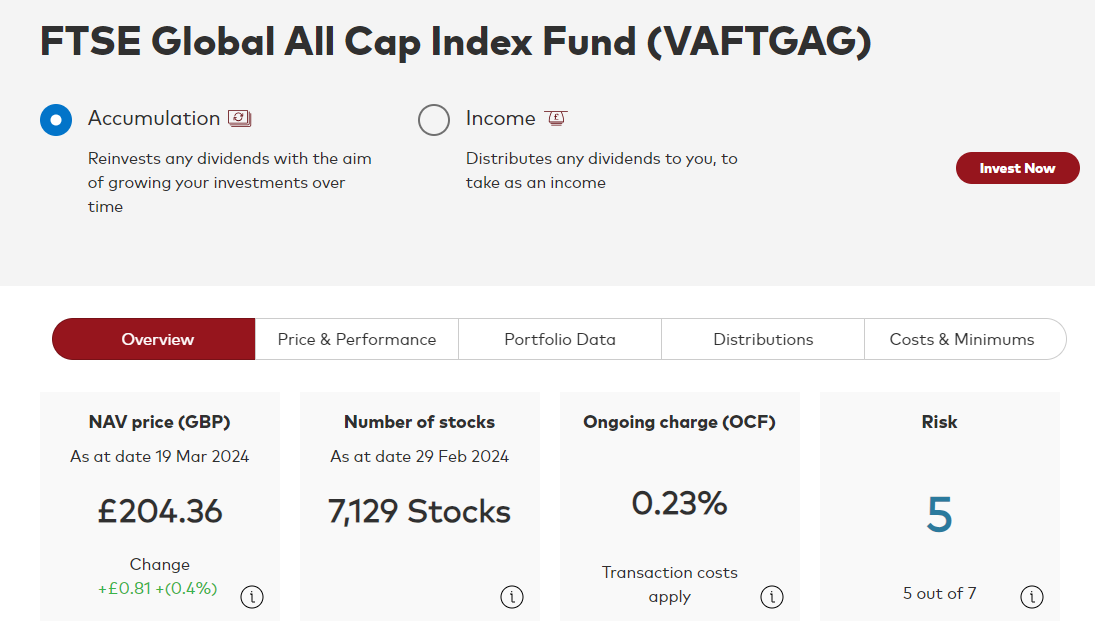

It’s important 1) to diversify and 2) to minimise fees. So a good option to put into your compounding machine is a low cost global equities tracker fund.

There are many such examples…here is one.

You can get cheaper funds than this…but it ain’t a bad starting point for comparison.

Is this the right fund for you?

It’s a good choice for anyone with some basic understanding of the stockmarket.

The question of “is this fund the right one for me?” is slightly strange.

Is it suitable for IT professionals? Yes, could be. For brunettes? Yes, could be. Is it suitable for younger people? Yes, could be. Is it suitable for older people? Yes, could be. I could go on but I think you get the idea…

Picking a fund is a bit like dating. It’s important to avoid “one-itis”. There is no single perfect fund so let’s not procrastinate waiting for your <Soulmate> before getting started.

What’s 2% between friends?

In the example above, where Kate ended up with over a million pounds, we assumed annual investment returns of 10% per year.

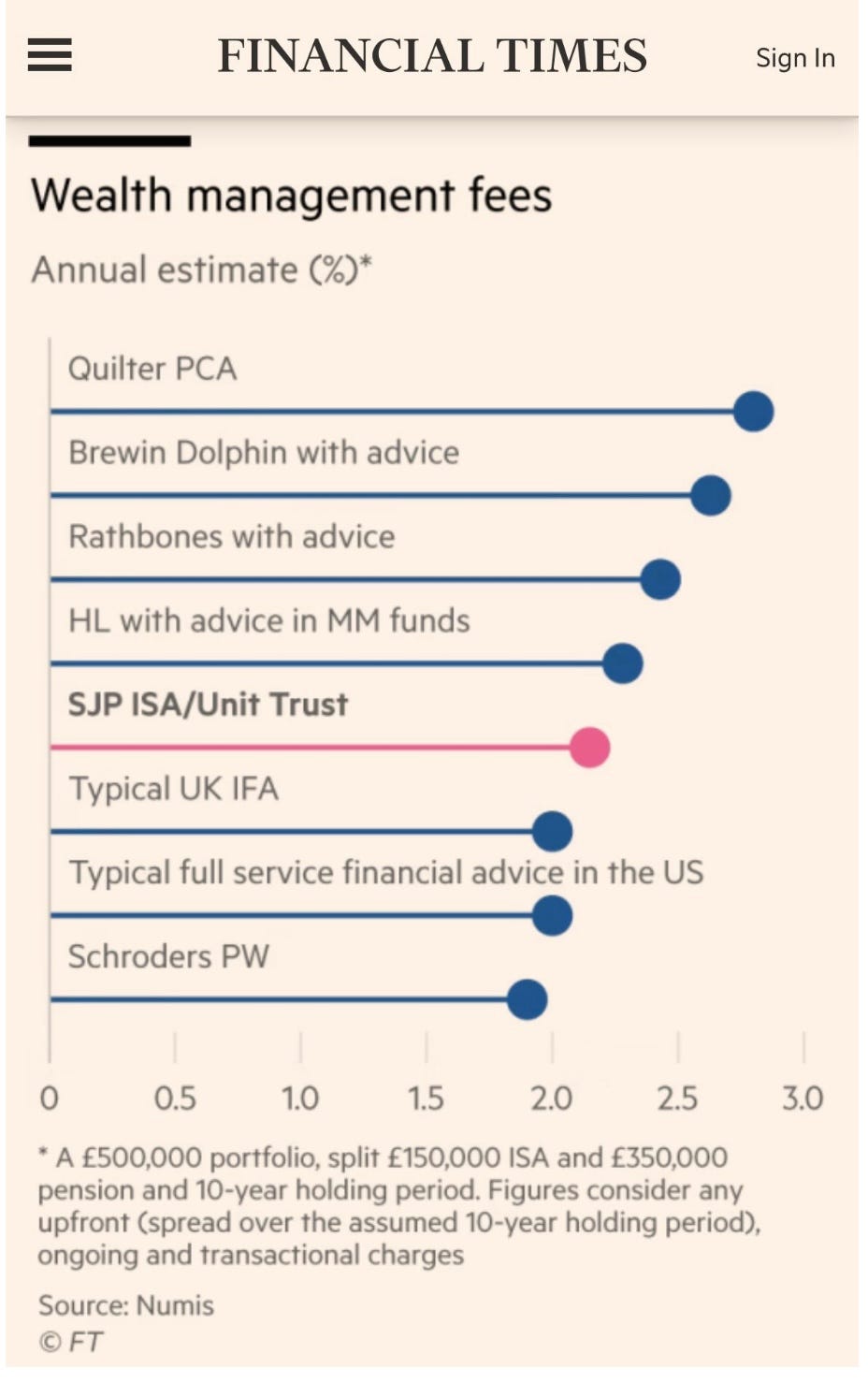

But what happens if she were tricked persuaded into paying the high fees of a wealth manager / active fund manager / expensive platform combo?

These fees can easily total 2% per year or more.

%Fees: You get what you don’t pay for

If the stockmarket delivers 10% per year before fees, then Kate only gets 8% per year net returns after fees of 2% per year.

And at 8% (after fees) returns per year, Kate’s portfolio does not grow to over £1 million, it only grows to £457,000.

In other words, paying 2% fees per year means that Kate ends up with a pension pot worth less than half of what it could & should have been.

This is why investing is different to other areas of life. When choosing between funds with different % fees, you get what you <don’t> pay for.

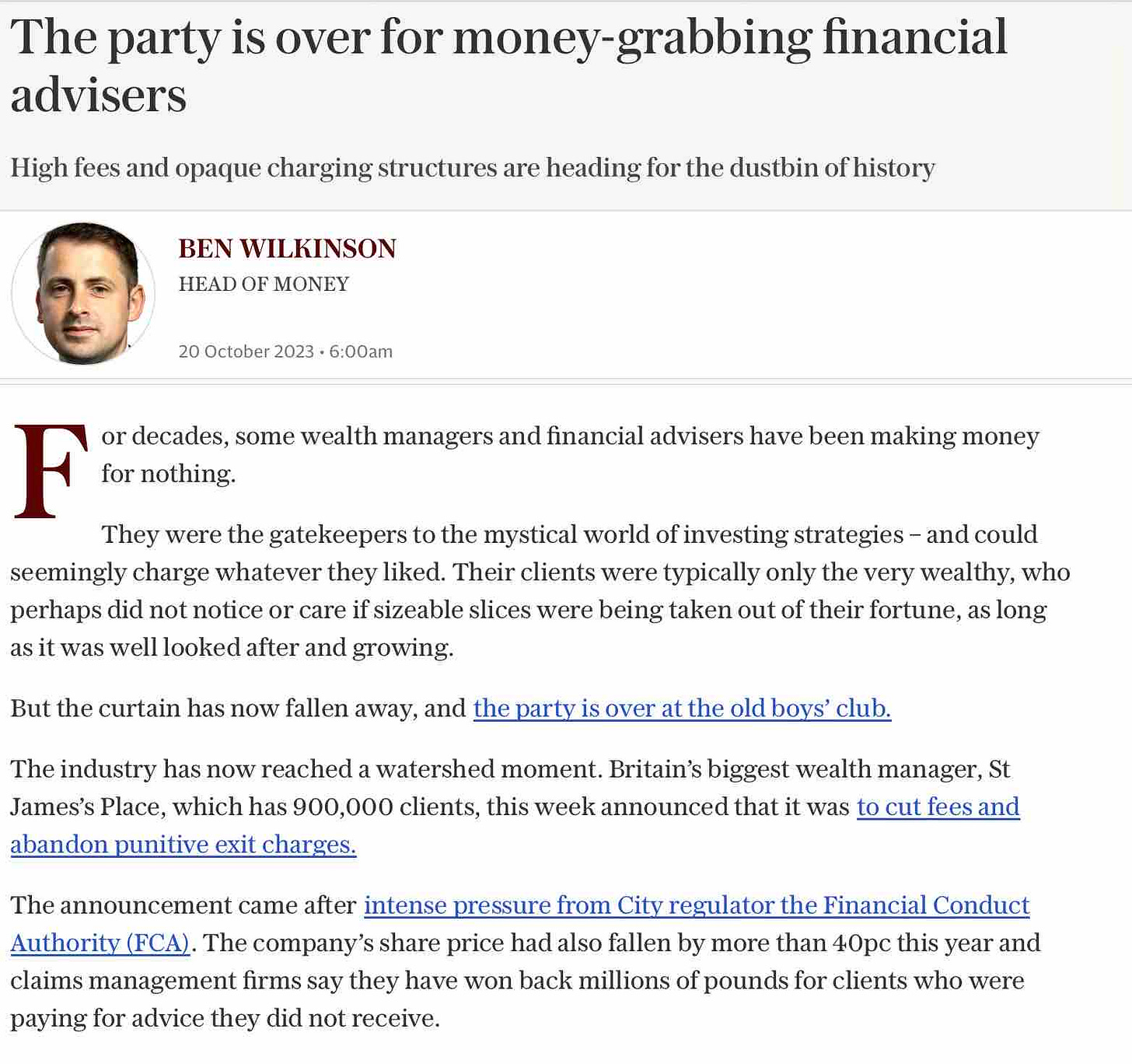

Why does high % fees persist when it’s as simple to set up an online investment account yourself as it is to open an online bank account and pay a gas bill?

I had an exchange on Twitter with a financial planner about this.

I posted that it’s weird that people pay high fees to wealth managers to choose a fund for them when they could just buy something like the Vanguard Global All Cap Index Fund.

They responded asked:

“Does that fund help you in the aftermath of a divorce, or creating a legacy for your children or forming a robust retirement plan or reduce your tax burden?”

I responded that yes, it could help in all those scenarios…especially when combined with some real financial coaching.

I know what you’re thinking: how selfless of me to promote my financial coaching! I know!!!

To be fair, I agreed with them that this fund could even be combined with real financial planning…as long as it’s at a clear and transparent price.

They were (I think) making the point that there remains a role for financial planners in guiding people through life transitions, navigating tax, helping people create a financial plan etc. This is a totally valid perspective.

I just think that people should have a choice.

The information anyone would need to invest their own portfolio is all out there hidden in plain sight. The problem is not lack of information, it’s information overload.

The fact that people can do it themselves gets obscured by the jargon, the paperwork, the media and the unnecessary complexity engineered into the financial services industry by a mixture of industry malpractice and the resulting heavy-handed regulation.

In my financial coaching I help people learn to invest themselves by making complex things simple to understand.

Money and investing which are my areas of deep-subject matter expertise (I worked in corporate finance for ~20 years and since then I have done financial coaching for ~10 years).

When money is in its correct place (i.e. working for you in the background) then you are freed up to tackle the bigger challenges of health, career, relationships, meaning & purpose etc.

Love to everyone

Barney

This article first appeared on my Substack email newsletter

good post thank you